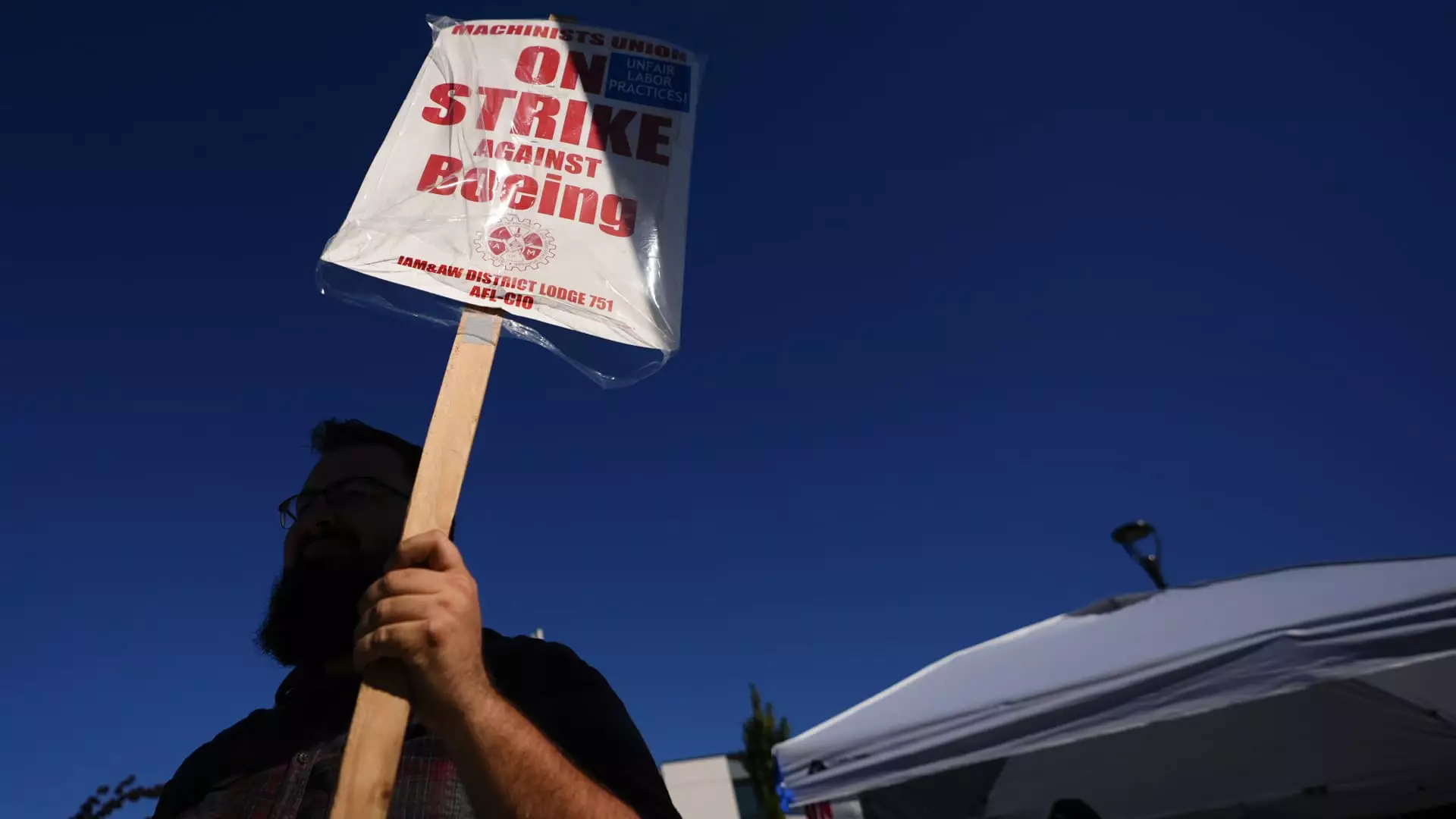

Boeing finds itself grappling with significant turmoil after machinists from the International Association of Machinists and Aerospace Workers (IAM) staged a strike involving over 30,000 workers. This job action was prompted by a resounding rejection of a tentative contract, intensifying the already present instability within the aerospace giant. The ripple effects of this strike are forcing Boeing to confront not only immediate financial losses estimated at over a billion dollars a month by S&P Global Ratings but also longstanding operational and reputational challenges that have plagued the company.

The timing could not be more precarious for the new CEO, Kelly Ortberg, who stepped into the role amid a turbulent backdrop that includes safety scandals and production delays. The issues began a year fraught with setbacks, including a significant incident involving the 737 Max, marking a transition from crisis mode to a desperate need for resolution. Now, as the strike halts production in various factories across the Seattle area, it leaves Boeing vulnerable to long-term cash flow issues and growing pressure from stakeholders.

At the heart of the upheaval lies a deadlock in negotiations between Boeing’s management and the machinists’ union. After an initial offer was rejected by an overwhelming 95% of union members, optimism within the company quickly soured. Analysts, such as Harry Katz from Cornell University, are now weighing the potential duration of the strike, estimating an additional two to five weeks of labor unrest could easily roll forward if Boeing fails to make a more compelling offer.

Adding to the complexity, Boeing recently filed an unfair labor practice complaint against the IAM. This escalation only furthers tensions, indicating that the relationship between management and union is increasingly strained. Jon Holden, the union president, has criticized Boeing’s traditional tactics as outdated, arguing that employees simply want assurances that their needs are recognized and met through effective negotiation.

The absence of paychecks and the loss of company-supported health insurance for striking workers compound these challenges, although the easing of the job market and the availability of alternative work opportunities do provide some cushion for workers facing hardship.

As the strike continues, Boeing is contending with significant financial repercussions that extend beyond temporary cash flow impairments. The company’s recent preliminary financial results paint a grim picture, predicting a loss of nearly $10 per share for the third quarter. This projection comes alongside revelations of around $5 billion in anticipated charges across commercial and defense sectors, underscoring the systemic issues leading to an alarming trend: Boeing has not posted a profit since 2018.

CEO Ortberg has acknowledged the need for drastic action, announcing a planned 10% reduction in the global workforce and a pause on the production of certain commercial aircraft. These decisions highlight the precariousness of Boeing’s situation, as investors grow nervous amid ongoing struggles with production quality, labor relations, and overall execution of programs.

Some experts suggest that resolving the challenges associated with the 737 production line could stabilize Boeing’s finances significantly. Yet, the prevailing sentiment is that the company risks exacerbating its troubles by pursuing aggressive cost-cutting measures while areas of production remain idled due to the strike.

The fallout from Boeing’s troubles is not isolated to the manufacturer alone; the implications extend to its suppliers and the broader aerospace industry. As Boeing faces operational disruptions, its suppliers, such as Spirit AeroSystems, are contemplating possible furloughs as part of their contingency plans, indicating a chain reaction that could dampen the entire supply chain’s viability.

While the company has been proactive in attempting to stabilize the workforce post-COVID-related layoffs, the current strike introduces uncertainty that could jeopardize these initiatives. Moreover, the specter of potential downgrades in credit ratings looms ominously, adding another layer of urgency for Ortberg and his team.

Ultimately, as Boeing seeks to regain its footing while navigating these turbulent waters, it must address immediate labor disputes and implement long-term strategies for fiscal and operational recovery. This dual focus on stabilization and innovation will be critical if Boeing hopes to emerge from its current crisis and rebuild trust and confidence among its stakeholders. The coming months will be pivotal, shaping not only the industry’s dynamics but also Boeing’s legacy as a leading figure in aerospace manufacturing.