The financial markets are often influenced by the affiliations and actions of prominent figures, and the recent announcement of Donald Trump Jr. joining the board of PSQ Holdings serves as a prime example. In a striking demonstration of how political lineage can affect corporate stocks, shares of the online marketplace operator PublicSquare skyrocketed by an astonishing 270.4%, reaching $7.63 on the day following the news. This surge raises intriguing questions about the dynamics between political connections and market performance.

PSQ Holdings operates within the commerce and payments sector with a niche focus on values tied to “life, family, and liberty.” Such a positioning not only alerts investors to its ideological standpoints but also attracts a specific clientele interested in aligning their purchasing power with their principles. As a microcap stock with a market cap of approximately $72 million, PSQ reflects significant growth potential; however, it also possesses inherent risks associated with smaller companies in volatile markets.

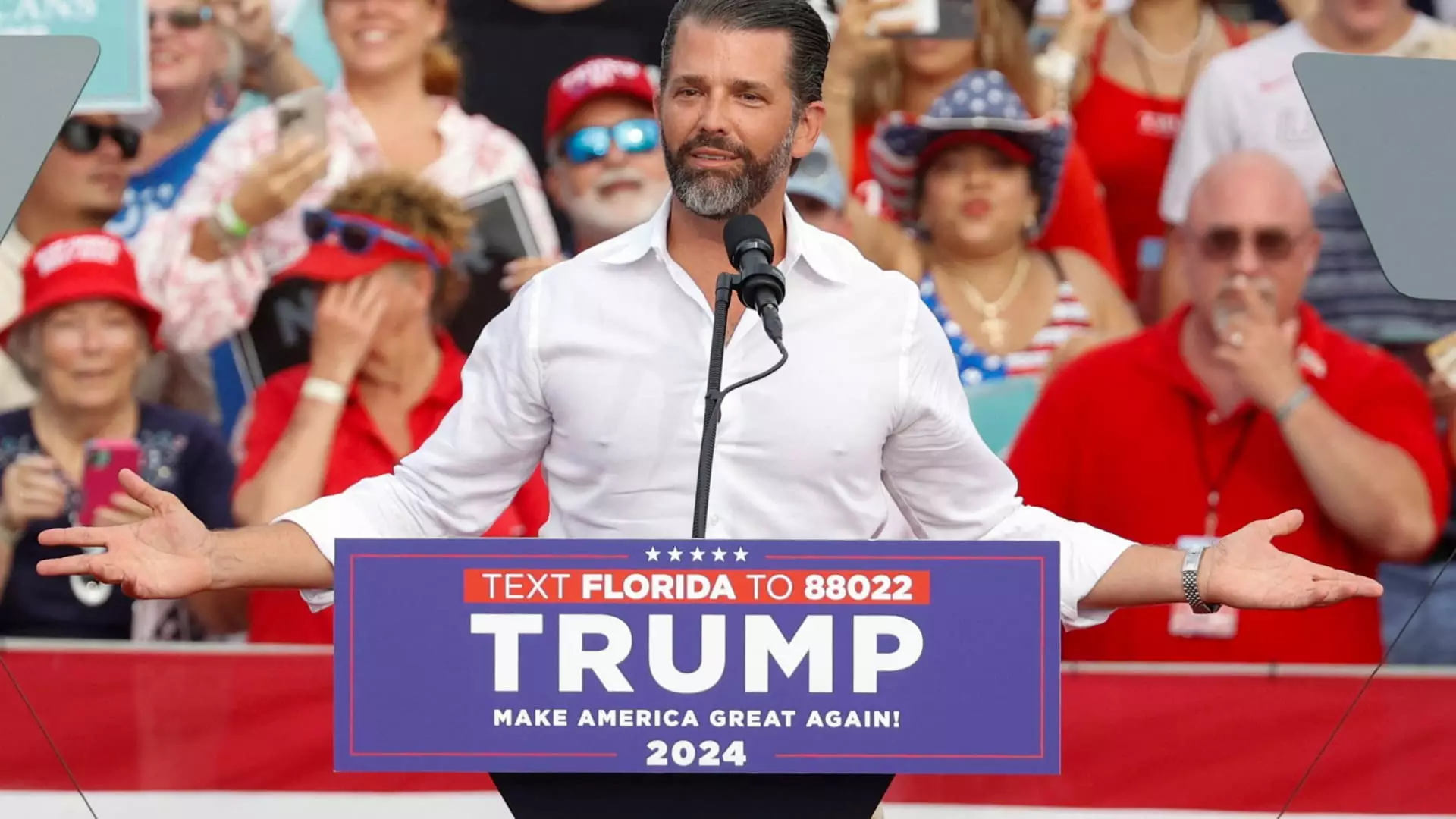

Donald Trump Jr.’s pre-existing investment in PublicSquare and his newly appointed role on its board are emblematic of the merge between capitalist ventures and political advocacy. CEO Michael Seifert underscored the value of Trump Jr.’s participation by highlighting his commitment to establishing a “cancel-proof” economy, suggesting a direct correlation between his business acumen and the company’s strategic direction. This rhetoric taps into a growing consumer sentiment among individuals who prioritize businesses that align with conservative values amidst increasing polarization.

Despite the jubilant response from investors, it is essential to contextualize this surge with the company’s financial realities. PublicSquare reported only $6.5 million in net revenue for the September quarter, while facing operating losses exceeding $14 million. The juxtaposition of apparent investor enthusiasm against such financial hurdles underscores a potentially speculative bubble based on expectations rather than solid fundamentals.

This spike in PSQ’s stock prompted broader discussions regarding the influence of political affiliations in business settings. Recently, Trump Jr. also joined other organizations like Unusual Machines and 1789 Capital, affecting their stock prices positively upon announcements. These occurrences exemplify how affiliations with politically charged figures can open doors for investment and expansion, though they also invoke scrutiny regarding long-term sustainability.

As seen through the recent flurry surrounding PSQ Holdings, while political ties can create immediate financial opportunities, they also harbor potential risks for investors. The volatile nature of microcap stocks and the relevance of fundamental performance metrics cannot be overlooked. Stakeholders must remain vigilant and critical, recognizing that market surges based on external affiliations may not always translate to enduring financial success. The intersection of politics and commerce continues to evolve, and investors should tread carefully in these murky waters.