In the fast-paced world of stock trading, premarket movements often foreshadow broader trends for the day ahead. Recently, several companies made headlines with significant intraday fluctuations, reflective of broader economic sentiments and internal corporate developments. This analysis delves into recent shifts in stock prices among prominent retailers and financial firms, exploring the implications of their earnings reports, analyst upgrades, and unexpected accounting concerns.

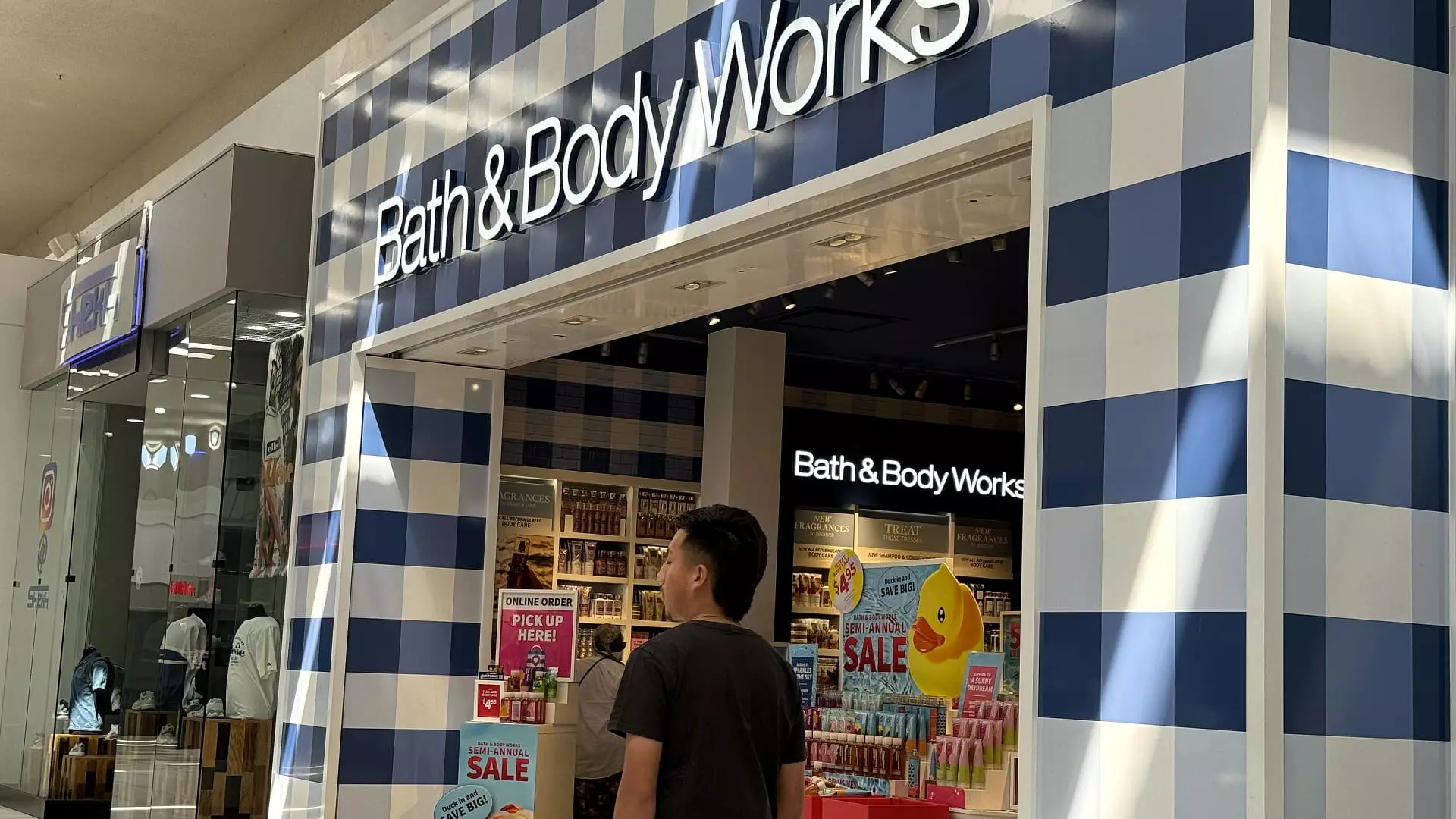

Bath & Body Works stands out in this report, boasting a staggering 16% increase in share prices following their impressive third-quarter earnings. The retailer reported earnings of 49 cents per share, coupled with revenue hitting $1.61 billion, surpassing the Wall Street expectations of 47 cents and $1.58 billion respectively. This notable performance not only underscores Bath & Body Works’ ability to navigate market challenges but also signals potential growth opportunities in consumer spending, especially in the beauty and personal care sector. Investors appear more confident in the company’s trajectory, influencing the stock’s positive momentum.

Another noteworthy mention is Robinhood, whose stock gained over 7% after an upgrade from Morgan Stanley, which changed its stance from “equal weight” to “overweight.” Analysts forecast that the brokerage firm could see robust revenue growth post-election, attributed to potential increases in stock trading activity and easing regulations in the cryptocurrency space. This optimistic outlook suggests a renewed consumer interest in trading, reflecting broader economic conditions and investor sentiment. The upgrade of Robinhood indicates a strategic shift and highlights the increased confidence in its long-term viability.

Conversely, Macy’s faced a setback with a 3% decline in share value due to the revelation of significant accounting discrepancies. The retailer disclosed that an employee intentionally manipulated financial entries to conceal delivery costs, amounting to errors between $132 million and $154 million. While Macy’s assured stakeholders that these irregularities have not impacted its liquidity, the news understandably raised concerns among investors, reflecting the critical importance of transparency and integrity in financial reporting. Such issues can erode trust and impact investor confidence, making it essential for the company to address these challenges head-on.

In further developments, Abercrombie & Fitch experienced a 3% gain in anticipation of robust third-quarter earnings. Market analysts project earnings of $2.39 per share, driven by a strong showing from both Abercrombie and its Hollister brand. The growing enthusiasm among investors mirrors recent positive sentiment from industry peers like Gap, hinting at a favorable holiday shopping season ahead.

Target’s stock also saw a modest uptick of nearly 2% after Oppenheimer labeled it as a top pick, highlighting its attractive dividend yield despite the stock’s 12% decline this year. This suggests that even amid broader market challenges, there are pockets of opportunity.

Lastly, MicroStrategy and Santander also posted gains, driven respectively by price target revisions and upgrade by analysts. Their movements further illustrate how analyst perspectives can shift market dynamics rapidly, revealing the complex interplay of internal performance and investor sentiment.

These developments reflect not only individual corporate performances but also larger economic indicators that influence stock market behaviors. Whether through strong earnings reports, unexpected scandals, or optimistic analyst upgrades, the fluctuations in premarket trading show how responsive investors are to both external economic conditions and internal corporate matters. Understanding these dynamics can provide valuable insights for investors navigating today’s intricate market landscape.