The stock market often serves as a barometer of economic health and investor sentiment, with companies’ shares fluctuating based on news, earnings reports, and market forecasts. The midday trading session of the current week highlights a variety of companies that have captured investors’ attention, revealing trends that may shape future trading strategies. This article delves into the latest movements of select companies and explores the implications of these developments for the market at large.

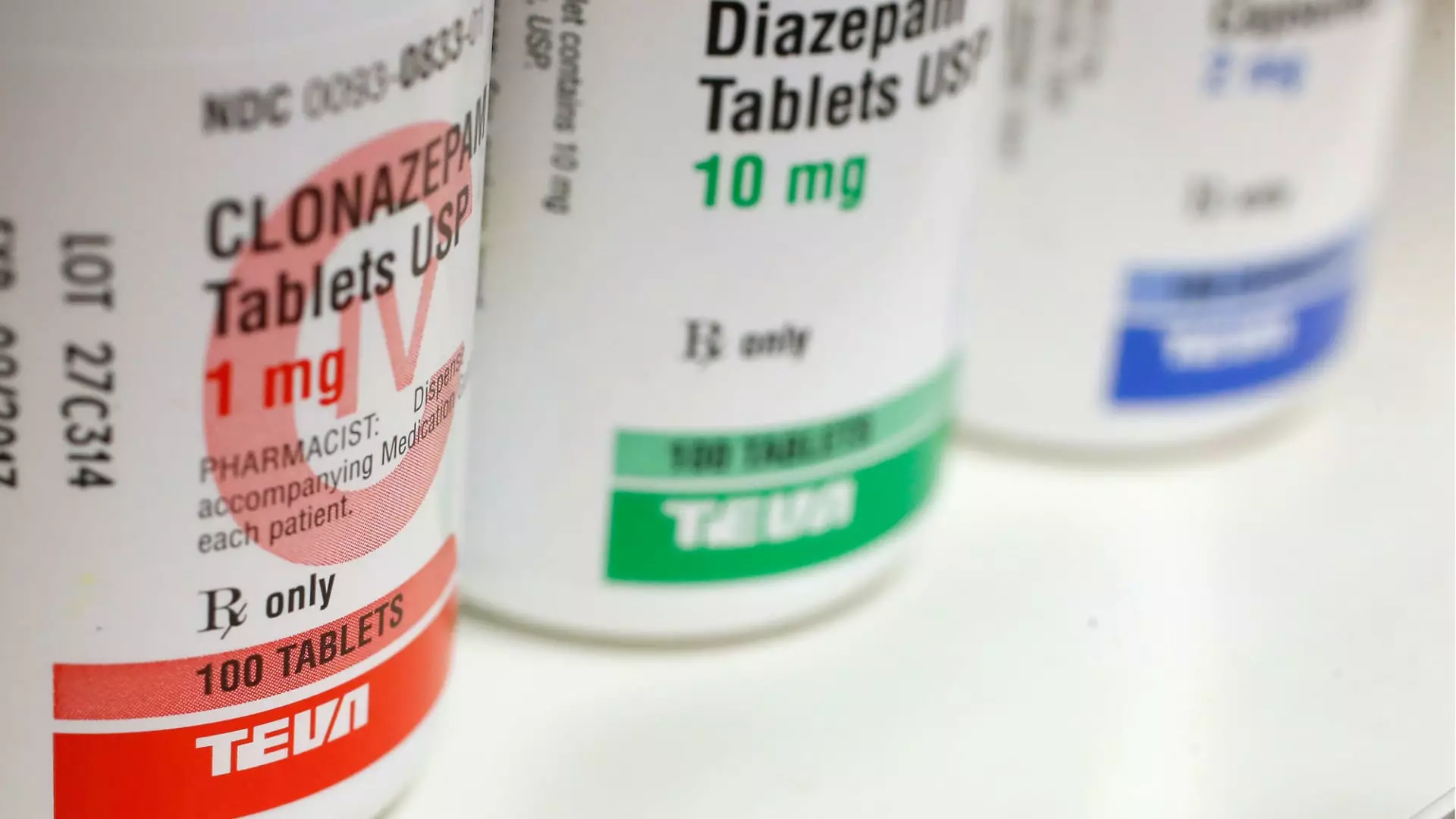

Teva Pharmaceuticals and Sanofi stood out in midday trading, experiencing substantial increases in their share prices. With Teva’s stock skyrocketing by more than 23% and Sanofi’s by over 6%, this surge can be attributed to their announcement of favorable Phase 2b clinical results for duvakitug, a medication targeting moderate to severe inflammatory bowel disease. This collaborative treatment marks a significant advancement in the pharma sector, showcasing the impact of successful drug trials on stock valuations. Investors generally respond positively to promising clinical data, often leading to immediate and noticeable gains, highlighting the volatility and impact that pharmaceutical developments can have on the stock market.

In a more tempered yet still optimistic movement, Pfizer’s shares rose about 4% in response to its 2025 financial outlook, aligning closely with Wall Street’s expectations. Projected revenues between $61 billion and $64 billion reinforce investor confidence, particularly against a backdrop of fluctuating market conditions. Analysts often scrutinize pharmaceutical forecasts for indications of how drug pipelines and market positioning will perform. By meeting consensus estimations, Pfizer mitigates concerns about volatility, reinforcing its status as a stalwart in the biopharmaceutical industry.

An extraordinary surge of over 38% in Quantum Computing’s stock catapulted it to a new 52-week high, largely fueled by a significant contract from NASA’s Goddard Space Flight Center. This contract, which revolves around cutting-edge imaging and data processing techniques enabled by the company’s Dirac-3 machine, underscores the growing interest in quantum technologies. Investments in innovation often reflect broader market optimism as firms pivot towards advanced technological solutions for complex problems, enhancing their market presence and appeal to investors looking for growth in niche sectors.

SolarEdge Technologies experienced a notable rise of 21% as Goldman Sachs upgraded its recommendation from sell to buy. Analysts predict that 2025 will be pivotal for the company as it undergoes a significant transformation aimed at dominating the clean energy landscape. Goldman Sachs’ assessment points to an exciting juncture for investors, indicating that clean energy initiatives are not just trends but potential long-term growth avenues.

Contrastingly, stocks of Nvidia and Broadcom faced downward pressure, falling over 1% and nearly 5%, respectively. Nvidia’s decline into correction territory signals potential investor concern over valuation, especially after a period of retraction in the tech market. In contrast, Broadcom’s performance remained relatively strong following a successful earnings report, demonstrating how divergent paths can exist within the same sector influenced by individual company performance and investor expectations.

The commercial sphere also exhibited volatility with companies like Red Cat and Amentum Holdings. While Red Cat saw its stock plunge by 12% after disappointing earnings, the rise of drone technology following recent sightings illustrates how emergent trends can interfere with traditional financial metrics. Conversely, Amentum’s quarterly results unveiled a pro forma loss, prompting a 12% decline, which illustrates how the market may quickly react to less favorable news regardless of broader sector trends.

As midday trading draws to a close, the varied performances among these companies encapsulate a tapestry of market responses to clinical results, forecasts, government contracts, and company-specific challenges. Understanding these dynamics is crucial for investors navigating the complex and often unpredictable financial landscape.