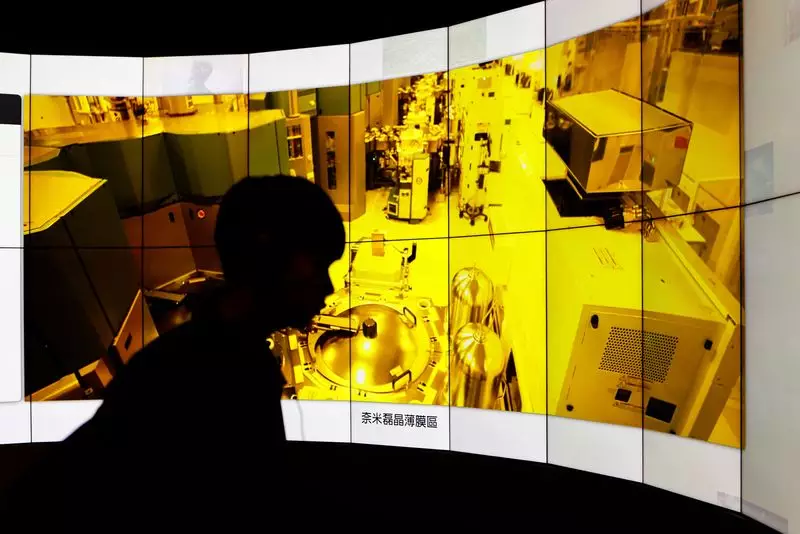

The U.S. government’s ongoing strategic approach towards technology exports to China, particularly in the semiconductor domain, has recently witnessed significant actions, specifically involving the Taiwan Semiconductor Manufacturing Company (TSMC). This decision, as part of a larger agenda, highlights the complex interplay of technological prowess and geopolitical tensions in the contemporary landscape.

The U.S. Department of Commerce has mandated TSMC to halt shipments of advanced chips, notably those designed with an architecture of 7 nanometers or finer. These advanced semiconductor components are crucial for high-performance systems, particularly in artificial intelligence (AI) and graphics processing units (GPUs). A key reason behind this initiative is the precedence of multiple violations reported regarding the use of TSMC chips in products intended for companies like Huawei, which has already faced a series of restrictions from U.S. authorities due to national security concerns.

This recent clampdown on TSMC comes shortly after an incident where a TSMC chip was identified in Huawei’s Ascend 910B AI processor. This processor is noted as one of the most advanced AI chips available from a Chinese manufacturer, amplifying anxieties within the U.S. government about the potential for American technology to be utilized in ways that could undermine U.S. national security.

TSMC, considered the backbone of the global semiconductor industry, now finds itself at a crossroads. By suspending shipments to Chinese customers, particularly those engaged in AI and GPU production, TSMC is not merely complying with U.S. regulations; it is also altering its operational dynamics in one of the most lucrative markets globally. This move could have far-reaching consequences not only for TSMC’s earnings but also for its standing among other semiconductor manufacturers, impacting its relationships with various stakeholders.

Furthermore, the U.S. directive is significant in its broader implications for the semiconductor ecosystem. As companies scramble to adapt to these restrictions, a ripple effect could emerge, fostering greater competition among global manufacturers seeking alternatives to TSMC or aiming to seize the market share left by constrained Chinese firms. This situation could promote innovation among competitive entities as they navigate the evolving regulatory landscape.

Regulatory Landscape and Its Evolution

The approach taken by the U.S. in imposing these export restrictions is rooted in a broader strategy aimed at gaining a technological edge over China. Past actions, including prior export restrictions on major players like Nvidia and AMD, have laid the groundwork for these current limitations on TSMC. Moreover, this new directive is reflective of a shift in the U.S. strategy—now allowing for expeditious regulatory action without prolonged bureaucratic inertia. The “is informed” letter issued to TSMC is just one mechanism by which the Department of Commerce intends to maintain control over the semiconductor supply chain.

Despite reported delays in promulgating updated regulations concerning tech exports, the urgent nature of these restrictions indicates the Biden administration’s adherence to a rigorous enforcement policy. The implications for companies beyond TSMC are substantial, raising questions about how other organizations engaged with Chinese clients will adapt to these tumultuous regulations.

As the U.S. takes substantial steps to limit the export of critical semiconductor technology to China, the ramifications of this policy are likely to be numerous and multifaceted. TSMC’s commitment to compliance marks it as a law-abiding entity; however, the broader implications for the semiconductor industry’s integrity raise ongoing questions about the balance between innovation, market access, and national security concerns.

In a technological race characterized by rapid advancements, companies must acclimate to a reality in which the U.S. plays an influential role in dictating the terms of engagement in global markets. Moving forward, the semiconductor industry will need to navigate a painstaking path filled with regulatory challenges and shifting market dynamics, ultimately shaping the future of technology on a global scale.